Acquisition Project | Stable Money

Introduction

Stable Money is a Bengaluru-based fin-tech startup founded in 2022 by Saurabh Jain & Harish Reddy. With a mission to democratize fixed-return investments, Stable Money is transforming how Indian consumers engage with secure investment options. The startup has raised close to $20M from investors like RTP Global, Z47 (previously Matrix), Lightspeed, Titan Capital, and several angels.

WebsiteYoutube

Instagram

Elevator Pitch🎙️

Are you investing in assets which are not beating inflation? or have you not started investing yet, due to fear of high risk and not having enough knowledge? Worry not! we at Stable Money will guide you on how to invest in safe, low-risk assets, which beat inflation, giving up to 9.10% returns, without the hassle of visiting banks.

Confused? Hesitating? We understand!

Download the app, and call us. We will walk with you in your investment journey, every step of the way.

AndroidIOS

Understand your Product

Context:

Typically, a user interested in booking an FD with a bank would visit a nearby branch, where they have an account, get a form, stand in line to submit the form and money, and wait for the FD to open. They are expected to follow the same process at the time of withdrawal too. Banks have started creating mobile applications to improve access for their customers. However, each bank has its website and app, yet a very poor digital infrastructure.

Pain points for a retail investor

- Users can open an FD in banks where they have an account, and which are nearby. No means to compare FDs across banks, and book an FD in a bank which is not available nearby

- The process of booking an FD consumed a lot of time and had heavy paperwork

- Complex withdrawal process

- Poor digital infrastructure

- Users could only trust age-old banks like HDFC, ICICI, Axis etc, which provided low-interest rates. Information for the period of booking was also not provided easily

Pain points for banks

- Cannot open bank office in every location, hence cannot reach all consumers

- Poor digital infrastructure capabilities

- Slow processing, execution and different mindset

Hence, platform like Stable Money becomes a partnership-led Acquisition channel for them.

Solutions by Stable Money:

- Discover and compare FD offerings of 200+ banks on one platform

- Smart recommendations basis your specific investment needs, be it short-term, long-term, or only for emergencies

- Education and calculation of returns/expenses across varied financial queries

- No new bank account required

- Seamless process and paperless investment, and withdrawal, with multiple payment options, without the need to visit any offline setup

- 24/7 customer support

- Real-time updates and reminders regarding your investment

- Security with top-quality digital infrastructure

Upcoming Features:

- Communication of upcoming features maintains transparency and shows a promising future, hence building trust.

- Builds a sense of anticipation, exciting the user about the product, hence increasing chances of acquisition.

- Ensures users can understand value offerings, and can plan for the future.

Why will someone prefer Stable Money over directly investing in the bank?

Apart from all the features, Stable Money is ensuring transparent communication with the users, be it RBI insurance, or their fundraise, or the next set of features lined up. Everything is visible to the customers. Hence, gives confidence to the users that the platform is trusted. Additionally, Stable Money and some unheard banks borrow trust from each other to provide a seamless experience to the user.

Understanding Core Value Proposition

The main functionality of the Stable Money app is that it lets you compare and then create FDs with their partner banks and NBFCs within a few minutes without you having to physically go to the branch or fill up any forms offline.

Understanding the Users

User Research

Objective: Build an acquisition strategy for Stable Money by identifying what users are searching or spending time on and prioritize the channels accordingly.

Micro objective:

- Insight on user persona

- Insight into user behavior on mobile/digital media

- Insight into user's investment ideology, plans and spending behavior

- Insight on discovery

- Insight into core value proposition for the user

- Feedback on usage of the app

PS: The data will be skewed as I've found users from GrowthX community, and LinkedIn, which means they are educated professionals, actively thinking about money and investment strategies.

Primary Sources of Discovery of Stable Money by Users

Understanding your ICP

Type of ICPs

Criteria | User 1 (ICP 1) | User 2 (ICP 2) | User 3 (ICP 3) |

|---|---|---|---|

Name | Shreya | Vasantha | Ravi |

Age | 22 (21-26) | 29 (27-40) | 45 (41-60) |

Gender | F | M | M |

City | Bengaluru | Chennai | Bengaluru |

Investment Need | Emergency | Emergency, Short-term goal | Long-term |

Influencer/Blocker/Decision maker | Decision maker | Decision maker & Influencer | Decision maker |

Digital Platforms Used | Instagram, LinkedIn, Youtube, X, Zerodha | Instagram, LinkedIn, Youtube, X, Zerodha | Youtube, LinkedIn, Zerodha, ET Money |

Family Situation & Goals | Unmarried: No responsibility | Unmarried: Short and long-term planning | Married: Family and retirement plan |

Risk Apetite | Exploring stage (potentially high) | 15-25% safe | 45-60% safe |

Investment Knowledge (1-5) | 1 | 3 | 4 |

Solution | Comparison of multiple banks, like a "digital brochure", better ROI | High ROI, Good UI, | Tracking multiple banks, not a lot of trust |

Perceived Value of Brand | Good UI and offerings | Good UI and offerings | Good offerings but difficult to trust, established banks are not availabe |

Marketing Pitch | Emergency, planning for a trip/bike, High ROI and safe | Emergency, Plan for a car, Compare with 200+, Open FD under 3min without opening another account | Safe investment for retirement, RBI insured, money is with bank, 24/7 customer support, easy withdrawal |

Average Spend on the product | Typically tried with a small amount | Typically tried with a small amount | Typically tried with a small amount |

We have multiple users of a product and not all of them can be our ICP for whom we make our strategies, we need to prioritize.

Basis given framework, ICPs are prioritised as: ICP2>ICP3>ICP1

As per the stage of the company, Doubling down on ICP2 makes sense for acquisition, as there is huge TAM and appetite to pay, with active participation on multiple channels, hence creating an opportunity to experiment, and identify which channels are working.

Criteria | ICP 1 | ICP 2 | ICP3 |

|---|---|---|---|

Adoption Curve | Low | Low | High |

Appetite to Pay | Low | High | High |

Frequency of Use Case | Low | Medium | Medium |

Distribution Potential | High | High | Low |

TAM | Medium | High | Medium |

Understand Market

Competitive Analysis

- Banks & NBFCs - HDFC, ICICI, Axis, AU, Utsav, etc

- They have huge existing client base, which they can utilize to cross-sell FDs. With established systems, they can provide with multiple add-ons if an FD is opened

- Time in business and physical presence has built trust in users, especially for Tier 2+ cities, and non-tech savvy audience

- New-age startups - Wint Wealth, INDmoney, Paytm, ET Money, Kuvera, etc

- At the time when other platforms experimented with FD, the asset class provided very low interest rates, hence could not acquire customers

- Focus was on multi-assets across classes, could not establish their speciality in solving one problems

- Startups like wint wealth focussed on new asset classes at the time such as bonds, thus creating a new category and educating users on the same

Advantage for Stable Money

- Timing - Launched at a time when banks are providing high interest rates, thus making it easier to acquire customers

- GTM - Focus on capturing customer base focussed on FDs, which is the biggest compared to other asset classes

- Cross-sell new services to the existing user base, once established in a particular asset class

Having a 1st mover advantage, in FD segment, Stable Money stands ahead in terms of offerings compared to other digital first brands. It acts as an aggregator of bank FDs, and thus builds over offerings of the banks

Market Sizing

Total Addressable Market (TAM)

Population Of India: 1.45B

Internet Penetration: ~52

No. of Households (assuming 4 individuals in a household): 360M

No. of Households that invest in FDs (as per RBI): 95% => ~340M

Serviceable Addressable Market (SAM)

Internet penetration in India: 52%

No. of households with Internet (Assuming 60% basis above metric): 60% => 200M

Serviceable Obtainable Market (SOM)

Assuming Stable Money can capture 30% of these households: 60M

Designing Acquisition Channel

(keep in mind the stage of your company before choosing your channels for acquisition.)

Channel Name | Cost (Cost to Acquire) | Flexibility (Ease of scaling) | Effort to execute | Lead Time (time to result) | Scale (no. of people possible to target) |

|---|---|---|---|---|---|

Organic | Low | Low | High | High | High |

Paid Ads | High | High | Medium | Medium | High |

Referral Program | Low | Medium | Low | Medium | Medium |

Product Integration | Medium | Medium | Medium | High | High |

Content Loops | Low | Medium | Medium | Medium | High |

Basis the above framework of prioritizing the channels, and as per conversations done with ICPs, following channels will be prioritized -

Organic, Content Loop, Referral Program

Detailing your Acquisition Channel

Organic Channel

Stable Money is into a tough market where huge brands like HDFC, Axis, ICICI, and other banks have been existing in the market since a long time, hence have build trust and the algorithm for searches also prioritizes them. Hence, it will be extremely difficult without paid ads, and will take a lot of effort to get Stable Money organically on searches.

Note:

Two interesting things that Stable Money is already doing is:

- Writing blogs with reference to the names of these banks, which uplifts the trust on the platform for the algorithm

- Introduced, several ROI calculators so that users have multiple touchpoints to get to Stable Money website.

However, Stable Money can take advantage of a few existing platforms to stay visible in more searches:

- Quora: https://www.quora.com/profile/Stable-Money-1/posts

- It will be better if an actual individual creates similar content on quora as it builds trust in users mind, and multiple people upvote the same so that these answers are visible on the top.

- Reddit: https://www.reddit.com/r/personalfinanceindia/comments/1dd9ww9/wint_wealth_2024_review/,

- Stay more proactive on platforms where Stable Money is being searched, and respond through an individuals profile than company account.

- Staying active and doubling down on social media platforms like Youtube, LinkedIn, Instagram, where most of our users find us, will definitely be a plus. Few suggestions are shared in the Content Loop section.

- Partner with brands like clear tax: https://cleartax.in/s/partner-wintwealth

- Partner with big brands in fin-tech space, such as - https://zerodha.com/z-connect/rainmatter/wint-wealth-retailing-bonds

- Can target our partner banks to also write about Stable Money.

Stable Money can explore buying out an existing distribution network to speed up their process of creating content, building a loyal user base

eg - GripInvest with AltInvestor

Content Loop

Keeping in mind how digital fin-tech companies are expanding their distribution channels, and where the ICP of Stable Money are finding them most, for ref:

Objective: Awareness + Trust

Since the ICP is discovering Stable Money majorly through Youtube Podcasts, and currently Stable Money has around 1.4k subscriber, doubling down on the platform makes most sense.

- Stable Money should create content on Youtube aggressively.

- Users are looking for high returns in safe assets, save for emergencies, and short term goals.

- 3 types of content strategies can be defined here:

- Finance experts or influencers/Leadership from partner or trusted banks/early-retiree professionals: to talk about their journey, investment strategies, and sharing value of diversification

- Stable Money users: Their stories, and how they are using safe instruments to plan and fulfil their short term goals and save for emergencies

- Short videos on features provided by stable money, showcasing that they have worked on the user feedback

- Hook: Stories by experts and users with real-life investment planning strategies

- Generator: Users/Experts/Stable Money

- Distributor:

- Experts

- Stable Money Users

Note:

- These distributors can be motivated through affiliate route, if at all needed.

- From long-format podcasts, take snippets for short-format content, in that case the distributor channel can be expanded to Youtube shorts, Instagram reels, and Linkedin Posts (by users/experts/Stable Money)

Minor suggestions on youtube:

Objective is to build multiple touchpoints in the users mind to know what Stable Money offers.

- A dedicated video to share a glimpse of the offering of the youtube platform/Stable Money app, such as "How should one think about stable/safe investments" should be put on spotlight, so that any user coming can get a sense of what is the platform all about.

- Description update: The core value proposition should be visible at the top so that users can learn what Stable Money is all about.

- Can figure out a way to display videos created by others to be visible on Stable Money's channel also, in a selected way.

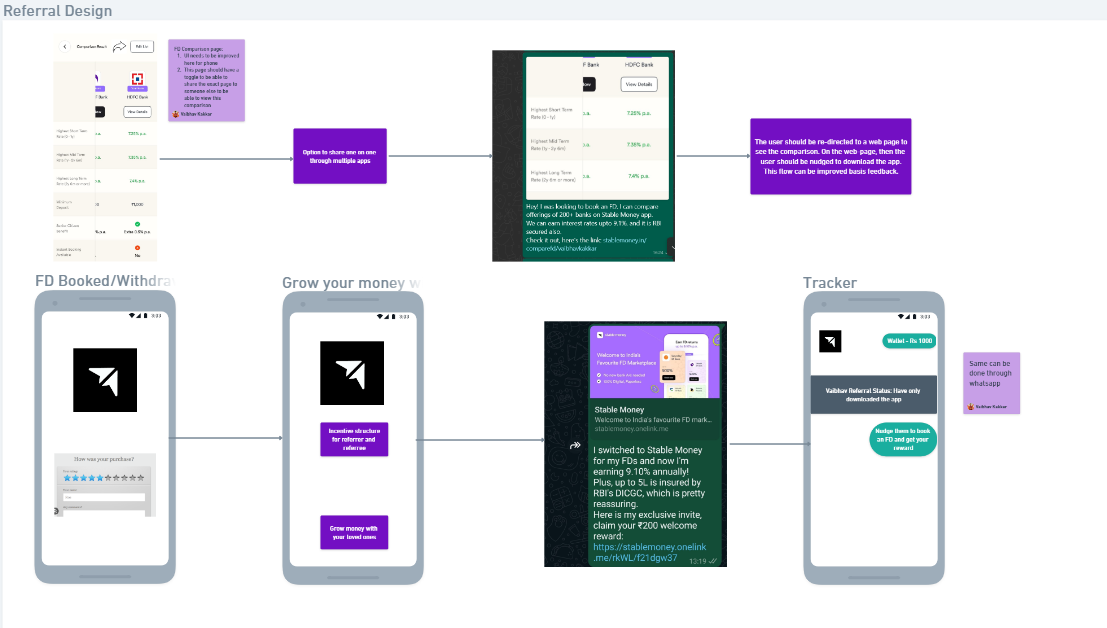

Referral Program/Partner Program

Referral becomes a big channel for Stable Money because as per user research, users got to know about it from someone.

Interestingly, as per my survey, users say that there is a 50% chance that they would suggest the app to the elders in the family (technically ICP 3 and seniors)

Notes about current referral program:

- Option to refer through my profile - says "Invite a friend", which is against to the ICP behavior. Can use more generic terms such as "loved ones"

- No reward for the referee

- Referrer is expected to have an active FD for referral

- Even though I can share through multiple apps, the symbol is only there for WhatsApp, confusing the user

Basis current offering, brag worthy moments, where user experiences the 'aha' moment are:

- Comparison of FDs

- After booking an FD

- After booking an Emergency Fund

- On withdrawal

Platform Currency:

- For Investors who booked an FD through Stable Money

- A small amount of say Rs 500 can additionally be credited per new user booking an FD, on Stable Credits, which could be invested by Stable Money on behalf of the user whenever the next FD will be booked.

- For users who have not booked an FD through Stable Money, who are referring to others

- A smaller amount of say Rs200 can be credited as Stable Credits, for every referral who books an FD. This amount could be invested by Stable Money on behalf of the user whenever an FD is booked by them.

- To maintain continuation of referrals, on reaching a certain amount of say 1000 credits, the referrer can get an option to convert these as Amazon vouchers, say of Rs500, without creating an FD.

Note:

- Giving credits to non-FD investors is a way to ensure that they keep using the app, with an intent that someday they might end up booking an FD, or might avail other future features

- WhatsApp messages should be sent on conversion, or as a reminder of credits, to ensure the program is on the top of the users mind

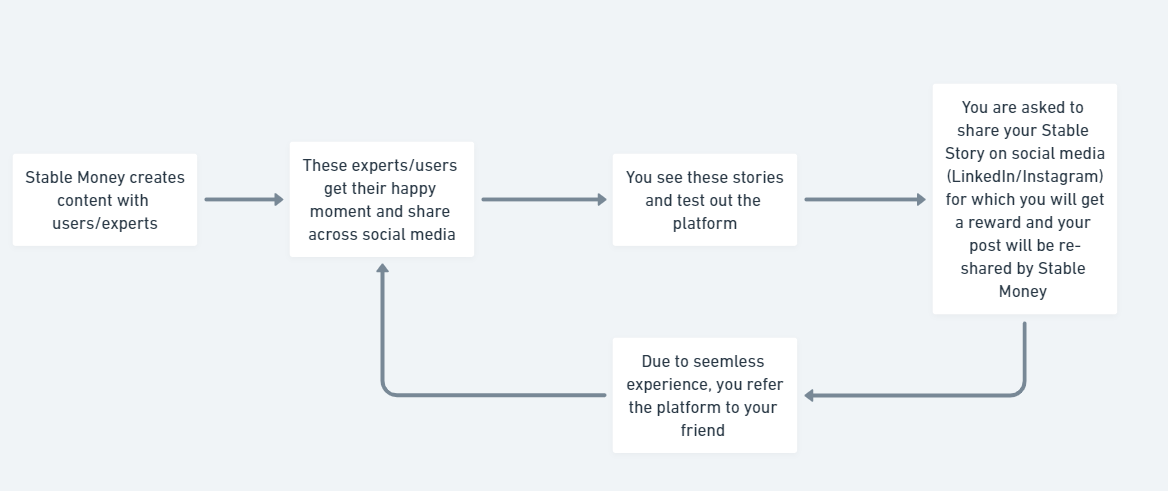

Recommended Referral Flow

Link

Additional minor recommendations on channel optimization

Since beginning, LinkedIn has been a good activation channel for Stable Money, where a lot of users come across stable money through Saurabh and other team member's post. Minor improvements might be useful.

Conclusion

Hope this information was fairly easy to comprehend. If any suggestions or improvements, or want to brainstorm casually about the offerings, please reach out to me and would love to chat!

Brand focused courses

Great brands aren't built on clicks. They're built on trust. Craft narratives that resonate, campaigns that stand out, and brands that last.

All courses

Master every lever of growth — from acquisition to retention, data to events. Pick a course, go deep, and apply it to your business right away.

Explore courses by GrowthX

Built by Leaders From Amazon, CRED, Zepto, Hindustan Unilever, Flipkart, paytm & more

Course

Advanced Growth Strategy

Core principles to distribution, user onboarding, retention & monetisation.

58 modules

21 hours

Course

Go to Market

Learn to implement lean, balanced & all out GTM strategies while getting stakeholder buy-in.

17 modules

1 hour

Course

Brand Led Growth

Design your brand wedge & implement it across every customer touchpoint.

15 modules

2 hours

Course

Event Led Growth

Design an end to end strategy to create events that drive revenue growth.

48 modules

1 hour

Course

Growth Model Design

Learn how to break down your North Star metric into actionable input levers and prioritise them.

9 modules

1 hour

Course

Building Growth Teams

Learn how to design your team blueprint, attract, hire & retain great talent

24 modules

1 hour

Course

Data Led Growth

Learn the science of RCA & experimentation design to drive real revenue impact.

12 modules

2 hours

Course

Email marketing

Learn how to set up email as a channel and build the 0 → 1 strategy for email marketing

12 modules

1 hour

Course

Partnership Led Growth

Design product integrations & channel partnerships to drive revenue impact.

27 modules

1 hour

Course

Tech for Growth

Learn to ship better products with engineering & take informed trade-offs.

14 modules

2 hours

Crack a new job or a promotion with ELEVATE

Designed for mid-senior & leadership roles across growth, product, marketing, strategy & business

Learning Resources

Browse 500+ case studies, articles & resources the learning resources that you won't find on the internet.

Patience—you’re about to be impressed.